How to Secure an SDB Loan for Coffee Shop : Complete Guide

If you are a Saudi entrepreneur (or an expat partnering with one), the SDB Loan for Coffee Shop sounds like a dream opportunity. It offers up to SAR 500,000 with zero interest and a long grace period, making it one of the most attractive funding options for launching a café in Saudi Arabia.

But if you think you can simply fill out a form online and find half a million riyals in your account next week, you are falling for the “marketing timeline.”

In reality, the SDB (formerly Bank Al-Tanmiah) process is a rigorous 3-to-5-month marathon that tests your credit history, your patience, and your ability to secure a qualified guarantor. This guide cuts through the official jargon and explains what actually happens — and how to realistically prepare so you can get funded without costly delays.

Quick Comparison: Which Loan Do You Need?

Most coffee shop owners apply for the wrong product. Here is the difference:

| Feature | Nafath (Freelance) | Riyada (Entrepreneur) ✅ |

| Max Amount | SAR 120,000 | SAR 500,000+ |

| Best For… | Coffee Carts / Home Roasters | Full Coffee Shops (Seating) |

| Requirements | Freelance Certificate (Waseeqat) | Commercial Registration (CR) |

| Processing Time | Fast (2-4 Weeks) | Slow (3-6 Months) |

| Feasibility Study | Not Required | Mandatory |

1. The “Saudi Only” Rule: What Expats Need to Know

Let’s address the elephant in the room. SDB loans are strictly for Saudi nationals.

If you are an expat looking to open a cafe, you cannot apply. Your Saudi partner must be the sole applicant.

- The Risk: The loan is a personal debt on your Saudi partner. If the business fails, they are banned from travel and blocked in Simah.

- The Structure: Ensure your Partnership Agreement clearly states how the loan repayments will be handled from the business revenue, so your partner feels secure.

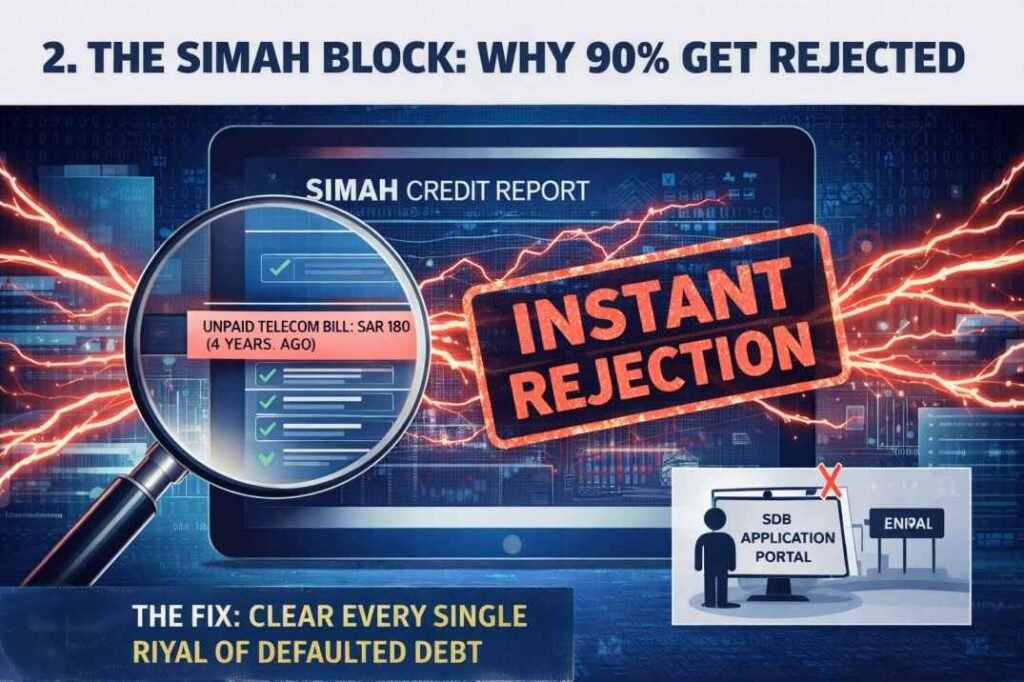

2. The “Simah” Block: Why 90% Get Rejected Initially

Before you even log in to the SDB portal, check your Simah (Credit Bureau) report.

SDB is incredibly strict. They do not just look at your “Credit Score”; they look for defaults.

- The Trap: Do you have an unpaid telecom bill of SAR 180 from 4 years ago? Or a dispute with a car rental agency?

- The Fix: You must clear every single riyal of defaulted debt. SDB integration with Simah is instant. If you are flagged, the system rejects you in seconds.

3. The “Kafeel” (Guarantor) Nightmare

This is the hardest part of the entire process. If the applicant does not have strong financial solvency (e.g., they are a student, unemployed, or have a low salary), SDB requires a Kafeel.

Who can be a Kafeel?

- Must be a Government Employee or a Private Sector employee with a strong company rating.

- Must not have an existing SDB loan or guarantee.

- Must have roughly 33% of their salary free to cover your monthly installment.

The Reality: Asking someone to be your Kafeel is asking them to risk their salary for 5-8 years. Many entrepreneurs stall here because they cannot find a family member willing to sign.

4. The Process: It’s Not Just “Apply and Wait”

For the Riyada (Entrepreneur) loan, you must jump through several hoops:

- Application: Submit on the SDB portal.

- The Interview: You will be invited for an interview to discuss your coffee shop concept. Tip: Know your margins. If you don’t know the cost of a latte vs. sale price, you will fail.

- The Course (Empretec/Riyada): You must attend a mandatory 3-to-5-day workshop on business management.

- Feasibility Study: You must submit a detailed study approved by an SDB-accredited office.

(Need help with the numbers? Check our Phase 1: Feasibility Guide)

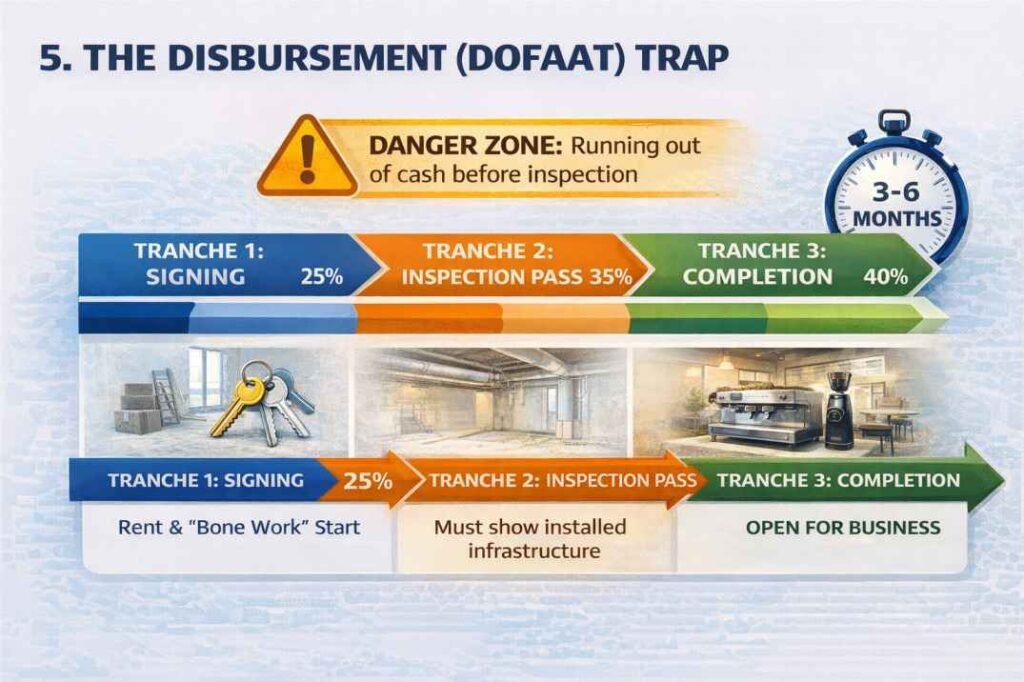

5. The “Disbursement” Trap (Dofaat)

Congratulations, you signed the contract! Now, where is the money?

SDB does not give you the full cash upfront. They pay in Tranches (Dofaat) based on progress.

- Tranche 1 (25%): Released after signing. You use this to rent the shop and start “Bone work” (AC/Plumbing).

- Tranche 2 (35%): Released ONLY after an inspector visits your site and sees the AC ducts and plumbing are installed.

- Tranche 3 (40%): Released after the shop is finished and equipment is installed.

The Danger Zone: Many owners run out of cash between Tranche 1 and 2. If you spend Tranche 1 on “Marketing” instead of construction, you will fail the inspection, and Tranche 2 will never come.

6. Approved Vendors Only

You cannot take SDB money and buy a used espresso machine from Haraj or a friend.

- Requirement: SDB requires VAT Invoices from registered commercial entities.

- Validation: When you submit receipts to unlock Tranche 3, they check the vendor’s VAT number.

- Advice: Buy your equipment from official distributors like Qavashop, Ekuep, or Sulalat. (See our Equipment Guide for the list).

Final Verdict: Is It Worth It?

Yes, because it is interest-free capital that saves you SAR 100,000+ in bank fees over 5 years. But you must treat the application like a full-time job.

Ready to start?

- Step 1: Check your Simah report.

- Step 2: Find a Kafeel.

- Step 3: Calculate your startup costs to ensure you ask for the right amount.

Leave a Comment